The major drivers for the siding market are expanding construction activities developing repair and upkeep of structure outsides and an ascent in the hospitality.

Canadian siding market size.

Industry market size for siding contractors.

Global demand for siding cladding is projected to rise 2 8 per year through 2022 to 6 7 billion square meters.

Market size industry statistics.

The world siding market cladding to 2019 research report forecasts the global demand to rise over 4 2 annually through 2019 to nearly six billion square meters valued at 80 billion with north.

Published september 2019.

Market statistics historical us and canadian production data.

Georgia pacific dutch lap vinyl siding.

Us demand to rise 7 1 annually through 2018 us demand for siding is forecast to rise 7 1 percent yearly to 103 5 million squares in 2018 valued at 12 1 billion.

Hampton red woodgrain dutch lap vinyl siding.

The cost of vinyl will depend on the type and qualities you are going for.

Product sales will be driven by growth in nonresidential building construction activity and an acceleration in global new home construction.

Figure on 20 squares and 5 000 to 10 000 in labor for a typical 2 300 square foot house.

And canada production data for softwood plywood osb glulam timber i joist and lvl further details on structural panels and engineered wood production and markets are available for purchase.

Access free historical u s.

Weigh the look you like against upkeep and cost.

Industry statistics cover all companies in the united states both public and private ranging in size from small businesses to market leaders in addition to revenue the industry market analysis shows information on employees companies and average firm size.

9 60 per 10 square feet.

Prices listed are per square 100 square feet.

Siding demand in the us is forecast to increase 2 0 annually through 2023 to 105 8 million squares.

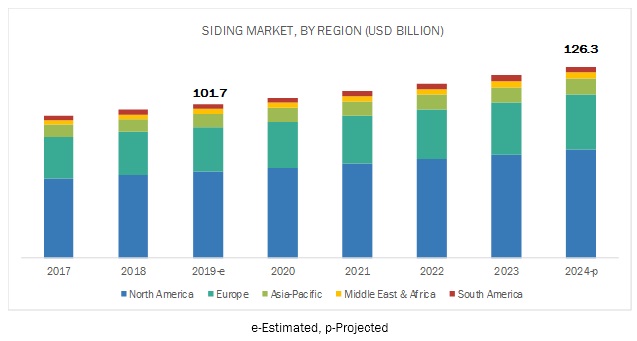

Global siding market is estimated to grow from usd 101 7 billion in the year 2019 to usd 126 3 billion by the year 2024 at a cagr of 4 0 during the forecast period 2019 to 2024.

Demand growth will be driven by rising home renovation activity increases in new housing construction and an expansion in commercial building construction activity especially for offices industrial buildings and restaurants.

But overall it stands up well next to other popular options like brick faring well in most canadian climates.